Micro, Small, and Medium-Sized Enterprises (MSMEs) are essential for stimulating innovation, creating jobs, and advancing economic progress. Various programs and efforts have been put in place by governments all around the world to help and acknowledge these businesses.

Micro, Small, and Medium-Sized Enterprises (MSMEs) are essential for stimulating innovation, creating jobs, and advancing economic progress. Various programs and efforts have been put in place by governments all around the world to help and acknowledge these businesses.

The MSME sector is regarded as the foundation of the Indian economy, and in an effort to support and empower small enterprises, the Indian government has streamlined the registration procedure. We will go into the specifics of MSME registration portal in this article, along with its advantages and the easy steps involved in obtaining it.

MSME Registration: What Is It?

Micro, small, and medium-sized business (MSME) registration is a voluntary process intended to give recognition to these businesses. It is the government's official admission that the business fits inside the MSME definition.class.

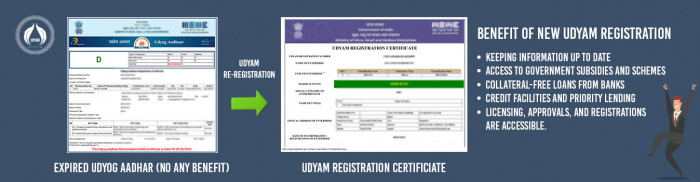

Numerous advantages are provided by the registration, such as easy commercial transactions, financial help, access to subsidies, and credit support.

Advantages of Registering with MSME:

Collateral-free loans: Under a number of government initiatives, registered MSMEs are eligible for collateral-free loans, which encourage financial inclusion and facilitate the expansion of their businesses.

Credit support and subsidies: MSMEs benefit from cheaper interest rates, priority sector financing from banks, and subsidies on a range of government programs and initiatives.

Government procurement and tendering: MSMEs can only take part in government procurement and tendering procedures, which creates new business chances.

Defense against postponed payments: The Micro, Small and Medium Enterprises Development (MSMED) Act provides regular financial flow by protecting registered MSMEs from late payments.

Income tax benefits: To promote the expansion of MSME's, the government offers exemptions from income taxes, benefits from capital gains taxes, and tax rebates.

Technology and skill development: Support and assistance are provided to registered MSMEs for research, technological advancements.

Qualifications:

For an enterprise to qualify for MSME registration, it must meet the specified thresholds for both investment and turnover:

Micro Enterprise: Maximum revenue of Rs. 5 crore and maximum investment of Rs. 1 crore.

Small Business: Up to Rs. 50 crore in revenue and up to Rs. 10 crore in investment.

Medium-Sized Business: Up to Rs. 250 crore in revenue and up to Rs. 50 crore in investment.

Documents Needed to Register an MSME:

PAN card of the business and the applicant's Aadhaar card

Proof of business address

Copies of the invoices for any machinery or equipment purchases (if relevant)

Articles of Association (for corporations) or the Memorandum of Association and the Partnership Deed

Certificate of Incorporation (for corporations)

Procedure in Steps for MSME Registration:

Online Enrollment Procedure:

Step 1: Go to https://registrationmsme.com/, the official gateway for MSME registration.

Step 2: Select "New Registration" from the menu.

Step 3: Enter the necessary information, such as the business address, PAN number, entrepreneur's name, and Aadhaar number.

Step 4: Use OTP authentication to confirm the Aadhaar details.

Step 5: Enter the business's information, such as its kind, PAN, and bank account data.

Step 6: Give details about the company's operations, financial commitment, and workforce.

Step 7: Upload the required files in accordance with the outline.

Step 8: Examine and confirm the accuracy of the entered data.

Step 9: Pay any registration costs that may be due.

Step 10: Finish submitting the form.

Step 11: Following a successful submission, a number of acknowledgements will be generated.

In conclusion, small firms can access a multitude of advantages and assistance by registering as an MSME.

Businesses can access funding, subsidies, and government initiatives by obtaining this registration, opening doors for expansion and prosperity. Businesses can register as MSMEs by following the above-mentioned step-by-step method, whether they choose to do it online or offline.

Small businesses must take advantage of this chance and the benefits provided by the government in order to prosper in the cutthroat industry and advance the economic growth of the country.

Answers to Common Questions (FAQs)

Q1: How long is the MSME registration certificate valid?

A1: There is no need to renew the MSME registration certificate; it is valid for life.

Q2: If a company is already registered under another government program, is it still possible for it to apply for MSME registration?

A2: Absolutely, companies that have received other certifications or are registered under other government programs are still eligible to apply for MSME registration.

Q3: Is there a cost to register as an MSME?

A3: There is no payment associated with registering on the official government website. On the other hand, certain outside service providers could charge a small fee for helping with the registration procedure.

Q4: Is it possible for a company that provides services to register as an MSME?

A4: Yes, companies are in operation.For MSME registration, individuals in the manufacturing and service sectors are qualified.

Q5: After acquiring MSME registration, is it possible for a business to modify its registered address?

A5: By submitting the required paperwork to the relevant authorities, firms are able to amend their registered address.

6. Can an individual business seek for MSME registration?

A6: Sole proprietorship businesses are qualified to submit an MSME registration application. For registration, the proprietor's Aadhaar card may be utilized.

Q7: Is it possible to revoke or cancel an MSME registration?

A7: The authorities have the right to cancel or revoke a business's MSME registration if it no longer satisfies the qualifying requirements or if it gives incorrect information while registering.

Q8: Is it still possible for a company to file for MSME registration if it already has a GST registration?

A8: It is true that a company may still file for MSME registration even if it already has a GST registration. The two registrations are compatible.

Q9: Is MSME registration required in order to apply for bank loans?

A9: MSME registration is not required, however it can greatly increase the likelihood of securing favorable terms and collateral-free loans from banks and other financial institutions.

Q10: If a company is incorporated, is it still possible for it to register as an MSME?

A10: No, before submitting an application for MSME registration, enterprises must be legally recognized and in operation. One document needed for registration is the incorporation certificate.