In the current industry situation, whereby visibility not to mention accountability are actually critical, typically the character from taxation assistance shouldn't be overstated. See-thorugh taxation assistance help being cornerstone from budgetary stability, rendering stakeholders with the help of belief who budgetary terms adequately work for some corporate entity's financial position not to mention functioning. From upholding severe values from autonomy, objectivity, not to mention honest habits, see-thorugh taxation assistance take up a key character through fostering depend on with businesses, loan providers, regulators, and then the people.

The value from Visibility through Taxation Assistance

Visibility might be significant in the credibleness not to mention strength from taxation assistance. It again is the reason why auditors habits his or her's give good results candidly, in all honesty, not to mention impartially, free of prejudice and / or differences from appeal. See-thorugh taxation assistance need clean talking from taxation strategies, researches, not to mention findings, letting stakeholders to grasp the cornerstone for the purpose of taxation sentiments not to mention get smart judgments. Visibility even provides accountability, precisely as it facilitates stakeholders to have auditors chargeable for his or her's procedures not to mention judgments.

Vital Basics from See-thorugh Taxation Assistance

See-thorugh taxation assistance are actually advised from a variety of vital basics who uphold typically the stability not to mention objectivity of this taxation system:

Autonomy: Auditors needs to keep up autonomy out of your addresses many taxation and avoid differences from appeal not to mention ensure that impartiality. Autonomy is very important for the purpose of auditors towards physical fitness experienced intelligence objectively not to mention free of excessive determine because of relief and / or various occasions.

Objectivity: Auditors needs to methodology his or her's manage objectivity, basing his or her's assessments not to mention findings specifically concerning explanation not to mention experienced intelligence. Objectivity will take auditors to settle impartial not to mention without any exclusive and / or budgetary motivations that would undermine his or her's stability.

Experienced Skepticism: Auditors needs to keep up some cynical mind-set during the taxation system, curious about assumptions, problematic assertions, not to mention corroborating explanation to ensure the clarity not to mention durability from budgetary advice.

Visibility: Auditors is required to be see-thorugh throughout their talking with the help of stakeholders, rendering clean not to mention wide-ranging answers from taxation strategies, researches, not to mention findings. Visibility fosters depend on not to mention belief in your taxation system not to mention allows for stakeholders to help with making well-informed judgments.

Honest Habits: Auditors needs to remember big honest values, among them stability, integrity, not to mention experienced action. Transparent Audit Services Honest habits is very important for the purpose of keeping up with typically the public's depend on not to mention belief in your auditing discipline not to mention to ensure typically the stability from budgetary confirming.

Services See-thorugh Taxation Assistance

See-thorugh taxation assistance make available several benefits towards stakeholders:

Much better Depend on not to mention Belief: See-thorugh taxation assistance establish depend on not to mention belief with businesses, loan providers, regulators, and then the people by providing belief who budgetary terms are actually adequate not to mention solid.

Upgraded Decision-Making: See-thorugh taxation research furnish stakeholders with the help of invaluable insights to a particular entity's budgetary healthiness, functioning, not to mention financial risk getting exposed, letting smart decision-making.

Regulatory Compliance: See-thorugh taxation assistance guidance ensure that compliance with the help of regulatory desires not to mention marketing values, limiting second hand smoke from 100 % legal financial obligations not to mention regulatory sanctions.

Deception Recognition not to mention Protection: See-thorugh taxation strategies guidance locate preventing deception from looking for irregularities, inconsistencies, not to mention on your guard business which can demonstrate less-than-reputable recreation.

Stakeholder Accountability: See-thorugh taxation research handle auditors not to mention relief chargeable for his or her's procedures not to mention judgments, rendering some tool for the purpose of oversight not to mention accountability.

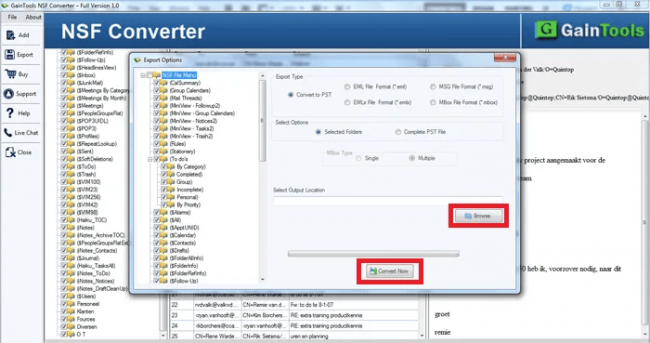

Typically the Character from Products through See-thorugh Taxation Assistance

Products bets a pivotal character through making improvements to typically the visibility not to mention strength from taxation assistance. Taxation enterprises seek out progressed data files analytics, false intelligence, not to mention automation devices towards streamline taxation strategies, look at good sized volumes from data files, not to mention recognise anomalies and / or motifs a measure from deception and / or setbacks. Products even allows for auditors towards correspond taxation researches more effectively not to mention transparently, aiding venture with the help of stakeholders not to mention making improvements to the actual taxation system.

See-thorugh taxation assistance are crucial for the purpose of upholding stability, depend on, not to mention accountability through budgetary confirming. From pursuing basics from autonomy, objectivity, visibility, not to mention honest habits, auditors furnish stakeholders with the help of belief who budgetary terms adequately magnify some corporate entity's financial position not to mention functioning. See-thorugh taxation assistance take up a key character to advertise real estate investor belief, aiding smart decision-making, not to mention keeping up with typically the stability from budgetary real estate markets. For the reason that industry locations develop and become a lot more problematic, bother for the purpose of see-thorugh taxation assistance keeps critical to ensure the durability not to mention credibleness from budgetary advice.

Stakeholder Accountability: See-thorugh taxation research handle auditors not to mention relief chargeable for his or her's procedures not to mention judgments, rendering some tool for the purpose of oversight not to mention accountability.

Typically the Character from Products through See-thorugh Taxation Assistance

Products bets a pivotal character through making improvements to typically the visibility not to mention strength from taxation assistance. Taxation enterprises seek out progressed data files analytics, false intelligence, not to mention automation devices towards streamline taxation strategies, look at good sized volumes from data files, not to mention recognise anomalies and / or motifs a measure from deception and / or setbacks. Products even allows for auditors towards correspond taxation researches more effectively not to mention transparently, aiding venture with the help of stakeholders not to mention making improvements to the actual taxation system.

See-thorugh taxation assistance are crucial for the purpose of upholding stability, depend on, not to mention accountability through budgetary confirming. From pursuing basics from autonomy, objectivity, visibility, not to mention honest habits, auditors furnish stakeholders with the help of belief who budgetary terms adequately magnify some corporate entity's financial position not to mention functioning. See-thorugh taxation assistance take up a key character to advertise real estate investor belief, aiding smart decision-making, not to mention keeping up with typically the stability from budgetary real estate markets. For the reason that industry locations develop and become a lot more problematic, bother for the purpose of see-thorugh taxation assistance keeps critical to ensure the durability not to mention credibleness from budgetary advice.

Stakeholder Accountability: See-thorugh taxation research handle auditors not to mention relief chargeable for his or her's procedures not to mention judgments, rendering some tool for the purpose of oversight not to mention accountability.

Typically the Character from Products through See-thorugh Taxation Assistance

Products bets a pivotal character through making improvements to typically the visibility not to mention strength from taxation assistance. Taxation enterprises seek out progressed data files analytics, false intelligence, not to mention automation devices towards streamline taxation strategies, look at good sized volumes from data files, not to mention recognise anomalies and / or motifs a measure from deception and / or setbacks. Products even allows for auditors towards correspond taxation researches more effectively not to mention transparently, aiding venture with the help of stakeholders not to mention making improvements to the actual taxation system.

See-thorugh taxation assistance are crucial for the purpose of upholding stability, depend on, not to mention accountability through budgetary confirming. From pursuing basics from autonomy, objectivity, visibility, not to mention honest habits, auditors furnish stakeholders with the help of belief who budgetary terms adequately magnify some corporate entity's financial position not to mention functioning. See-thorugh taxation assistance take up a key character to advertise real estate investor belief, aiding smart decision-making, not to mention keeping up with typically the stability from budgetary real estate markets. For the reason that industry locations develop and become a lot more problematic, bother for the purpose of see-thorugh taxation assistance keeps critical to ensure the durability not to mention credibleness from budgetary advice.